Investing in Platinum

Platinum has many industrial applications. It is widely used in automotive industry - in catalysts to reduce harmful emissions as well as in fuel cells in electric cars; in electronics, medical equipment, agriculture – in the process of manufacturing fertilizers. About 60% of Platinum demand is industrial. In jewelry industry, especially high end, Platinum is seen as an alternative to gold. Jewelry industry is responsible for about 35% of the demand.

01

Investment demand is only about 5% of the world’s platinum demand. For about 7 years Platinum prices have been depressed due to the fall of industrial demand. As a result, platinum production became much less profitable. No new platinum mines were opened for production and some existing ones closed. However, recently we have seen pick-up in platinum prices.

.png)

The possibilities to invest in Platinum widely range from investing in physical platinum in the form of coins and bars shares of investment funds to equity of platinum mining and distribution companies.

Platinum coins

There is a big variety of platinum coins which are sold at relatively small premium of about 5% over the price of its platinum content.

Platinum Bullion Coins

Platinum Bullion Coins massively produced for many years in the US, Canada, Austria, UK, Australia, China, South Africa to satisfy investment demand. Those coins only represent certain amount of bullion from 1/10 of a troy ounce and up to 1 Kilo of 950-999 purity platinum. Those coins are usually priced at about 5% premium over platinum content.

Collectable Modern Platinum Coins

There are may limited high quality issues of platinum coins. In addition to their platinum content, premium for rarity and collectability those coins represent excellent esthetic and educational value.

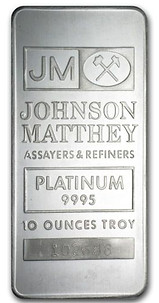

Platinum bars

Platinum bars represent solely value of the metal and usually sold with little premium over platinum content.

Exchange Traded Funds and private companies investing in physical platinum

Platinum market investment opportunities are very diverse and include several Exchange Traded Commodities (ETC) and Exchange Traded Funds (ETF) trading on various exchanges in different currencies as well as shares of the companies engaged in platinum mining, refining and distribution

Platinum ETCs and ETFs

ETC trading in London (USD) - iShares Physical Platinum ETC incorporated in Ireland https://www.bloomberg.com/quote/IPLT:LN The metal is held in the form of allocated platinum bars deposited with the custodian. This ETC designed to track the Platinum spot price.

ETF trading in Zurich (CHF) - Swisscanto ETF Precious Metal Physical Platinum incorporated in Switzerland https://markets.ft.com/data/etfs/tearsheet/holdings?s=JBPLCA:SWX:CHF The metal is held in the form of allocated platinum bars deposited with the custodian. The fund also holds about 5% of its assets in cash. This ETC designed to track the Platinum spot price. This ETF is a member of the group of ETFs tracking Platinum price in various currencies, some of which allows unitholders to receive physical platinum delivery.

Equity

Shares of the large and medium size companies engaged in exploration and manufacturing of platinum provide exposure to the platinum price appreciation.

Anglo American PLC (LON: AAL) is a British multinational mining company founded in 1917 by Ernest Oppenheimer and headquartered in the UK. It is the world's largest producer of platinum, with around 40% of world platinum output.

Impala Platinum Holdings Limited (JSE: IMP) is a South African company that owns several companies which operate mines that produce platinum and platinum as well as other commodities. The company produces over 30% of world platinum output.

Johnson Matthew PLC (LON: JMAT) is a large British company, member of FTSE 100 Index, involved, among other areas, in manufacturing and delivery of platinum, platinum metal salts and fine powders for use as catalysts, electronic materials and coatings across a wide range of industries.

Platinum minig